WILL THE DEMAND FOR INDUSTRIAL REAL ESTATE CONTINUE TO RISE ?

According to CBRE, the industrial real estate market in Southern Vietnam saw a slowdown in the first six months of 2025. The primary reason for this is believed to be investor and business concerns over the ongoing tariff policies between the United States and Vietnam. This has created a cautious sentiment, affecting investment decisions. Specifically, major industrial land transactions in the South were concentrated mainly in Q1/2025. The total absorbed industrial land area for the entire first half of 2025 reached 55 hectares.

This figure represents a significant decline, 1.7 times lower than the average quarterly absorption from Q1/2023 to Q1/2025. Despite the slowdown in transactions, the market’s rental prices and occupancy rates remained stable compared to the beginning of 2025 due to no new supply. The average rental price reached $179/sqm for the remaining lease term, with an occupancy rate of 89%.

CBRE notes that while the industrial land market trended slower, the ready-built warehouse and factory segment in the South recorded good occupancy rates in the first six months of 2025, with major transactions continuing into Q2/2025.

"Most large transactions came from businesses primarily operating in the logistics and e-commerce sectors, as well as companies looking to diversify their operational locations to mitigate potential impacts from tariff policies and reduce reliance on a single market," CBRE assessed.

According to the same report, in the first six months of the year, the total absorbed area for ready-built warehouses and factories was 300,000 sqm and over 400,000 sqm, respectively. It is noteworthy that for two consecutive quarters in early 2025, the absorbed area for both warehouses and factories exceeded the average level from Q1/2023 to Q1/2025. Occupancy rates reached positive levels in Q2/2025, with warehouses at 74% and factories at 93%.

Regarding rental prices and occupancy rates, CBRE believes that the ready-built warehouse and factory market continues to remain stable. The average rent for warehouses was $4.9/sqm, and for factories, it was $5.2/sqm, showing little change from the previous quarter.

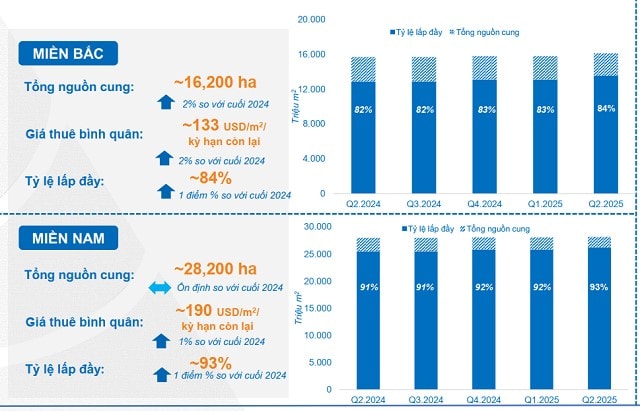

Similarly, a report from Dat Xanh Services (DXS-FERI) also suggests that stable supply, combined with a slight increase in demand, has helped the market maintain occupancy rates of 84% in the North and 93% in the South.

Industrial land rental prices showed a slight upward trend of 1-2% compared to the previous quarter in both regions, with the average price in the North around $133/sqm for the remaining term, while the South was about $190/sqm.

"The merger of administrative units, territorial restructuring, and urban expansion has created opportunities for comprehensive and scientific master planning. Previously fragmented, small-scale areas will be conveniently re-planned for the development of new urban areas, industrial parks, and concentrated residential clusters," DXS-FERI assessed.

For the second half of 2025, DXS-FERI expects an increase in demand for industrial real estate as Vietnam attracts shifting capital flows, helping foreign businesses accelerate the expansion of their factories, warehouses, and logistics centers. This will lead to a continued surge in demand for leasing industrial land, factories, and logistics properties.

Furthermore, supportive factors include an initial tariff agreement between the U.S. and Vietnam, which helps alleviate concerns about stringent reciprocal policies, and the diversification of supply chains by multinational corporations, along with policies supporting production expansion.

DXS-FERI forecasts that in the last six months of the year, the supply of industrial real estate in the North is expected to increase by about 5% and in the South by 3% compared to the end of 2024. While not a sudden surge, this increase is consistent with the progress of infrastructure projects and industrial planning in many localities. The absorption rate is also expected to remain stable at 83% (North) and 92% (South).

Regarding rental prices, the market may see slight fluctuations, with the average rent in the North at about $134/sqm for the remaining term (a 4% increase year-on-year) and in the South at $191/sqm for the remaining term (a 3% increase year-on-year).

Ms. Thanh Pham, Director of Research & Consulting at CBRE, noted that the Vietnamese industrial real estate market in the first half of 2025 continued to be significantly impacted by U.S. tariff policies, which have substantially reshaped investor strategies. Particularly, as we move into the second half of 2025, adjustments to the Corporate Income Tax (CIT) incentive policies will pose major challenges to the business strategies of industrial park developers.

"Even if direct government incentives may decrease, the pressure to maintain a competitive advantage and attract secondary investors remains very high. Therefore, simply relying on reasonable rental pricing may no longer be sufficient. Developers need to delve deeper into strategies for attracting long-term tenants while continuously upgrading products, amenities, and services to create differentiated value in a changing market landscape," Ms. Thanh Pham recommended.

Source: Enternews

Nguồn:

Related news

09/08/2025

VIETNAM AFFIRMS ITS POSITION AS A GLOBAL TRADE AND MANUFACTURING HUB

Vietnam Affirms Its Position as a Global Trade and Manufacturing Hub

09/08/2025

VIET NAM 'S INDUSTRIAL REAL ESTATE RENT HAS INCREASED BY 70%

VIET NAM 'S INDUSTRIAL REAL ESTATE RENT HAS INCREASED BY 70%

09/08/2025

U.S. RECIPROCAL TARIFFS OFFICIALLY TAKE EFFECT

U.S. RECIPROCAL TARIFFS OFFICIALLY TAKE EFFECT

09/08/2025

ESG TRENDS IN INDUSTRIAL PARK DEVELOPMENT IN VIET NAM

ESG TRENDS IN INDUSTRIAL PARK DEVELOPMENT IN VIET NAM

Copyright © 2022 Viet Huong IP., Ltd. All Rights Reserved

TOP